Confusión de Confusiones (Confusion of Confusions)

I think I have fully grasped usque ad ultimas differentias the meaning of the Company, its shares, its principles, its reputation, its splendor, its initiation, its progress, its administration, the distribution of profits, and its stability. But what has this to do with that mysterious business you mentioned, with the tricks you pointed out, with the difficulties you emphasized, with the entire exclusion of risk, with the changing of names, and with other exaggerations and expressions which have filled me with perplexity, rapture, and confusion? . . .

[Let me return to my assertions] that this business of mine is a mysterious affair, and that, even as it was the most fair and noble in all of Europe, so it was also the falsest and most infamous business in the world. The truth of this paradox becomes comprehensible, when one appreciates that this business has necessarily been converted into a game, and merchants [concerned in it] have become speculators. Had the conversion of these merchants into speculators been the only change, the harm would have been bearable, but, what is worse, a portion of the stock brokers have become card-sharpers and, though they are familiar with the blossoms, they nevertheless lose the fruits.1

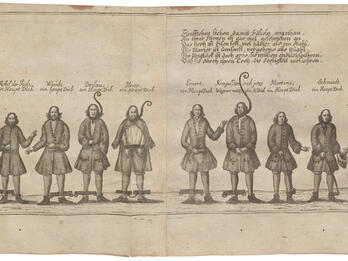

For a better understanding of this notable fact, is should be observed that three classes of men are to be distinguished on the stock exchange. The princes of business belong to the first class, the merchants to the second, and the speculators to the last.

Every year the financial lords and the big capitalists enjoy the dividends from the shares that they have inherited or have bought with money of their own. They do not care about movements in the price of the stock. Since their interest lies not in the sale of the stock but in the revenues secured through the dividends, the higher value of the shares forms only an imaginary enjoyment for them, arising from the reflection . . . that they could in truth obtain a high price if they were to sell their shares.

The second class is formed by merchants who buy a share (of 500 pounds) and have it transferred on their name (because they are expecting favorable news from India or of a peace treaty in Europe). They sell these shares when their anticipations come true and when the price rises. Or they buy shares against cash, but try to sell them immediately for delivery at a later date, when the price will be higher (i.e., for which date a higher price is already quoted). They do this from fear of changes in the [political or economic] situation or of the arrival of [unfavorable] information and are satisfied with [what amounts to] the interest on their [temporarily] invested money. They consider their risk as much as their profit; they prefer to gain little, but to gain that little with [relative] security; to incur no risk other than the solvency of the other party in this forward contract; and to have no worries other than those bound up with unforeseen events.

Gamblers and speculators belong to the third class. They have tried to decide all by themselves about the magnitude of their gains and, in order to do so, . . . they have put up wheels of fortune. Oh, what double-dealers! Oh, what an order of life has been created by these schemers! The labyrinth of Crete was no more complicated than the labyrinth of their plans. . . .

They buy one or twenty shares (the latter commitment is usually called a “regiment”), and when the twentieth of the month approaches (the date of delivery), there are only three possible means of settlement. First there is the sale of the shares, through which profit or loss will arise according to the purchase-price; then there is the hypothecation of the shares to four-fifths of their value (which is done even by the wealthiest traders without harm to their credit); and, finally, the buyer may have the shares transferred to his name and make the purchase price payable at the Bank—which can be done only by very wealthy people, because a “regiment” today costs more than a hundred thousand ducats.

When the date of settlement draws near, and if the shares can neither be taken up by the purchaser nor be hypothecated, they must be sold. The speculators for a decline in prices [i.e., the bears] are aware of this impasse and [try to] bring about a sudden fall in price in order to cause the shares to be sold below purchase-price. [Thus serious difficulties may arise for some of the speculators]. . . .

Several among those who are in difficulties (immoral people, of course) know how to free themselves through the following argument: The buyer is not obliged to pay for that which is bought; I lose in the purchase; therefore I am not obliged to pay.

Ghastly stupidity, unheard-of madness, frightful folly! . . . You assert that the speculator is not obliged to pay for his purchases, but I do not understand the reason for the lack of obligation. I doubt whether he can appeal to a juridical authority such as Bartolus or Baldus.2

This is the chief point and substance of the whole business. Of such complications would not even your Thales know anything, and from your Socrates one could only learn the wisdom that we do not know anything. Therefore I inform you that Solon is not alone as the giver of good laws. Frederick Henry, too, a shining star in the House of Orange-Nassau, promulgated (with wise motives) an ordinance for these provinces, according to which he who sold shares for future delivery without putting them on the time account should be exposed to the danger (because he has sold something he does not own) that the buyer will not take the pieces at the time fixed upon.3 When the speculators looked for protection through this recourse (which is called “to appeal to Frederick,” in accordance with the name of that famous governor), the storm stopped, the attacks ceased, and the disturbance died down. . . .

Translated by

.

Notes

Words in brackets appear in the original translation.

Here the author is indulging in a play on words, since in Spanish flor means both “flower,” and a “trick” of a card-sharp.

Bartolus (d. 1329) and his disciple Baldus (d. 1400) were important jurists of the 14th century, still highly regarded in the 17th.

See Introduction, p. viii.

Credits

Joseph Penso de la Vega, from Confusión de Confusiones, trans. Hermann Kellenbenz, Kress Library, no. 13, ed. Barry E. Supple (Boston, Mass.: Baker Library, Harvard Graduate School of Business Administration, 1957), pp. 4–6. Baker Library Historical Collections, Harvard Business School. Originally published in Spanish (Amsterdam, 1688). Used with permission of the publisher.

Published in: The Posen Library of Jewish Culture and Civilization, vol. 5.